Some success stories

Scenario 1 – Business Owner

Wealthy business owner and wife, mid-fifties, planning the next 20+ years

Where they are now

Age 54 and 49, married with 3 children, two of whom are at university . . . the youngest child is to attend university in 2010 after a year out travelling.

He lives and breathes his business, which has recently been affected by the 2008 credit crunch.

This has disturbed them to the degree that all their financial affairs might not be as rosy as they have thought. Like some of their friends, they too have been reliant to a significant degree on their borrowings, which have been eased by the rises in house prices in the past. This has enabled them to lead a high quality lifestyle which includes paying university fees amounting to £14,000 per year.

Their concerns

Their bank wants the business debts to be refinanced on tighter terms. Extra borrowing has been ruled out

The fall in house prices and tightening of lending means a likely reduction in income

The fall in their investment and pension fund values has worried them

The inheritance tax liability should the business be sold for its worth

Their requirements

To rebalance assets if possible, thereby reducing debts

To be able to pay for all children’s university fees and look after them after graduation (the eldest plans to be back home and work at a local firm of architects)

To spend more time at home with his wife and family

To go travelling together

What we did

Designed a personal financial plan which:

was based around their own values of what money means to them;

established their goals, objectives and aspirations;

enabled them to understand their current assets and how they work now and will do so in the future;

showed them at what age, based on their desired lifestyle, they will “run out” of money;

showed them what they will need to do, in order to maintain that desired lifestyle so they will never run out of money;

gave them hope and energy to make the necessary changes to achieve what they really want

Rearranged their personal residential loan liability in a more tax efficient manner . . . by recommending a different institution to discuss the possibility of refinancing existing debts in a more cost effective manner

Designed a bespoke investment strategy that would rebalance their existing investments and pensions in line with their individual objectives and risk tolerances . . . gave each need a risk level and target growth rate . . . organised all the investments in a way that enabled them to be in control and pay lesser charges

Referred them back to their solicitor to update their Will which would ease the IHT burden by . . . creating a discretionary will trust . . . insuring against the remaining liability

Referred them back to their accountant to seek a second opinion of the recommended tax and exit planning strategy

The Results for them

The financial organisation and prioritisation helped them to get a clear picture as to how they are positioned and what they are going to have to do in order to attain their future dreams.

The refinancing of the debts resulted in a saving of over £1,300 per month

The flexibility of the Lifetime Cash Flow Modelling gave them a clear picture as to how their finances work depending on what changes they make to their lifestyle

The financial plan showed that he can relax, work less and spend more time with his family as he wanted to do

The accountants approved the tax strategy which meant he had spare capital to . . . give his youngest son should he be accepted into Oxford . . . go on a holiday of a lifetime in 2010 with his wife

Peace of mind that their investments only had to achieve a moderate annual growth rate in order to satisfy their retirement income objectives

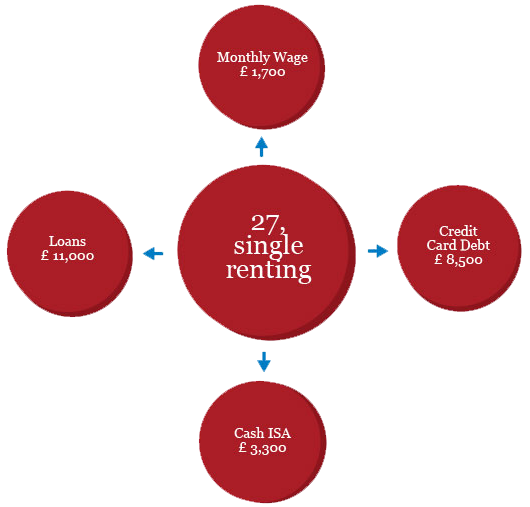

Scenario 2 – Young Professional

Mid-twenties, ambitious career-minded individual with credit card debts. Aiming to climb onto the housing market ladder.

Where they are now

Age 27, single, and getting settled into her career as an accountant at one of the top 3 institutions. About to complete the final phase of the ACA exams which, once passed, will make her a chartered accountant.

In addition to completing her exams, she has made it clear that she wants to buy a house as she feels rental money is a waste.

Although she has not found a suitable partner, she does express a desire to have children at some point in the not-so-distant future. It appears that work has taken control of her life to an extent that time has not been on her side to socialise and meet new people.

As our conversation develops, she reveals the reason why she works so much. It is because she wants to “feel that there is enough money”. Enough to be able to decide what she wants to do, and when. Just like looking in the mirror, she hasn’t taken a good look at her own finances. It becomes apparent that what is inhibiting her pursuits is her significant credit card debts which, at first, seemed embarrassing for her to even talk about.

Her concerns

The focus has been on work. Career, qualifications, and promotion have taken priority to an extent that work/life balance has been all around her job

There appears to be a lack of money as “what comes in goes out”

This lack of money makes her want to work harder… to the point that socialising is secondary to career.

Rental money is a waste in her opinion

Needs a significant sum to buy a house

Wants to reduce her credit card debts

Unsure of the employee benefits on offer and what to chose

Her requirements

To gain a clear understanding of her present situation and see for herself what is going on

To get a grip with her income/expenditure so that she is able to say “what comes in goes out…and I know what goes out is totally for my benefit”

To build up a deposit to buy a house

Spend more time socialising

What we did

Designed a personal financial plan which:

established her goals, objectives and aspirations;

detailed her income and expenditure pattern, highlighting where the majority of the money was going. On an annual basis, this showed that there was, in fact, spare capital which appeared to be going to waste;

reassured her that it was ok to have these debts as they were from her student days;

recommended that she repay these credit card debts with one loan from a bank. drafted a letter to the bank justifying the debt transfer and her ability to make the repayments;

recommended what employee benefit package she should ask her employer for once she passed the final exams;

recommended a structured income distribution plan which would repay the debts and build up a deposit

gave her hope and belief that she can take control of her debt problem and finances and be in a position to be able to do whatever she wants

The Results for her

The financial organisation and prioritisation helped her to understand herself better. It had the effect of a mirror. Until seeing it, she was not able to pinpoint what her finances looked like.

The refinancing of her debts resulted in a saving of over £1,600 per year. This enabled her to maintain her repayments which would see her loan be repaid in 5 years

At the same time she would be able to maximise her cash ISA elements each year which could eventually act towards a deposit and have spare capital to really know she can enjoy her life

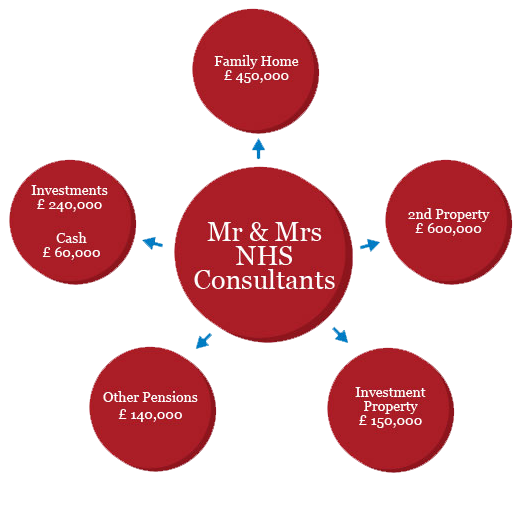

Scenario 3 – Mid 50s senior consultant

Public service employees, mid fifties, planning early retirement at 60

Where they are now

Age 57 and 55, married with 2 children, the youngest being at university.

A doctor with significant experience in the NHS and also having the luxury of being able to earn a secondary income by offering his expert opinions on medical cases. After a mild health scare, he has decided he should spend more time doing the things he values the most: being with his family and tracing his routes which span 3 continents.

His wife has not worked for some time. As the main breadwinner he wants to ensure that his wife and children will be looked after should anything happen to him. Throughout the years he has been saving and saving, much to the point he has no clear idea where anything is.

They have two debt free properties worth around £800,000 in total.

Their concerns

“We’re financially clueless” they say

To compensate, they have put money into most types of investment vehicles

“I wonder what the purpose of all these investments is…” they now ask

The liability to inheritance tax

The high amount of income tax paid annually

Their requirements

To be able to understand their current financial position

To know how retirement will alter their finances and lifestyle

To take steps now which will bypass inheritance tax (IHT). Gifting is an option but they want to retain control of the gifts

To restructure the investment and share portfolio so they understand the purpose of the whole arrangement

To create a bespoke investment strategy which will supplement their lifestyle once he retires with an NHS pension

To explore legitimate ways of reducing the amount of income tax paid

To give something back to the community through charitable planning

What we did

Identified their own values of what money means to them;

Designed a personal financial plan which:

was based around their values;

established their lifestyle requirements both now and in retirement

showed them that if they were to stick to their desired lifestyle, they had enough assets (including the NHS pension) meaning that they would never “run out” of money;

showed them the significant inheritance tax liability payable and what planning they could do now and in the future to mitigate this

illustrated how gifting via certain trusts could reduce the IHT liability, whilst still allowing them to retain control of the gifts

Created a bespoke tax mitigation strategy which incorporated charitable giving and various tax relief schemes which would reduce the annual income tax bill significantly

Designed a bespoke investment strategy that would rebalance their existing investments in line with their desired lifestyle….allowed them to log on to a website and be able to see their total investment value in one go and at any time

Referred them to a solicitor to update their Will which would ease the IHT burden by creating a discretionary will trust . . . and for a second opinion on the appropriate gifting strategy via trusts

Referred them back to their accountant to seek a second opinion of the recommended tax mitigation strategy

The Results for them

The financial organisation and prioritisation helped them to get a clear picture as to how they are positioned and what they can do with all the assets they have. This also took into consideration the potential vulnerability if he was to retire early due to ill health. Both these scenarios, illustrated graphically, gave them confidence in their overall bespoke strategy.

The financial plan showed that he can relax, work less and spend more time with his family as he wanted to do

The inheritance tax saved amounted to over £160,000 . . . the solicitor was happy to draw up a discretionary will trust and comment on the gifting which gave them extra reassurance

The accountant approved the tax strategy which meant he received a lump sum rebate of over £24,000 several months later.

The reorganising of the investments and viewing their financial plan gave them a clearer picture of their purpose. The ability to go online and see the total value of the portfolio together with its various constituents put them in a position of control.

Your home may be repossessed if you do not keep up repayments on your mortgage